KCM Articles July 30, 2025

According to Fannie Mae, 90% of buyers don’t actually know what credit score lenders are looking for, or they overestimate the minimum needed.

Let that sink in. That means most homebuyers think they need better credit than they actually do – and maybe you’re one of them. And that could make you think buying a home is out of reach for you right now, even if that’s not necessarily true. So, let’s look at what the data really says about credit scores and homebuying.

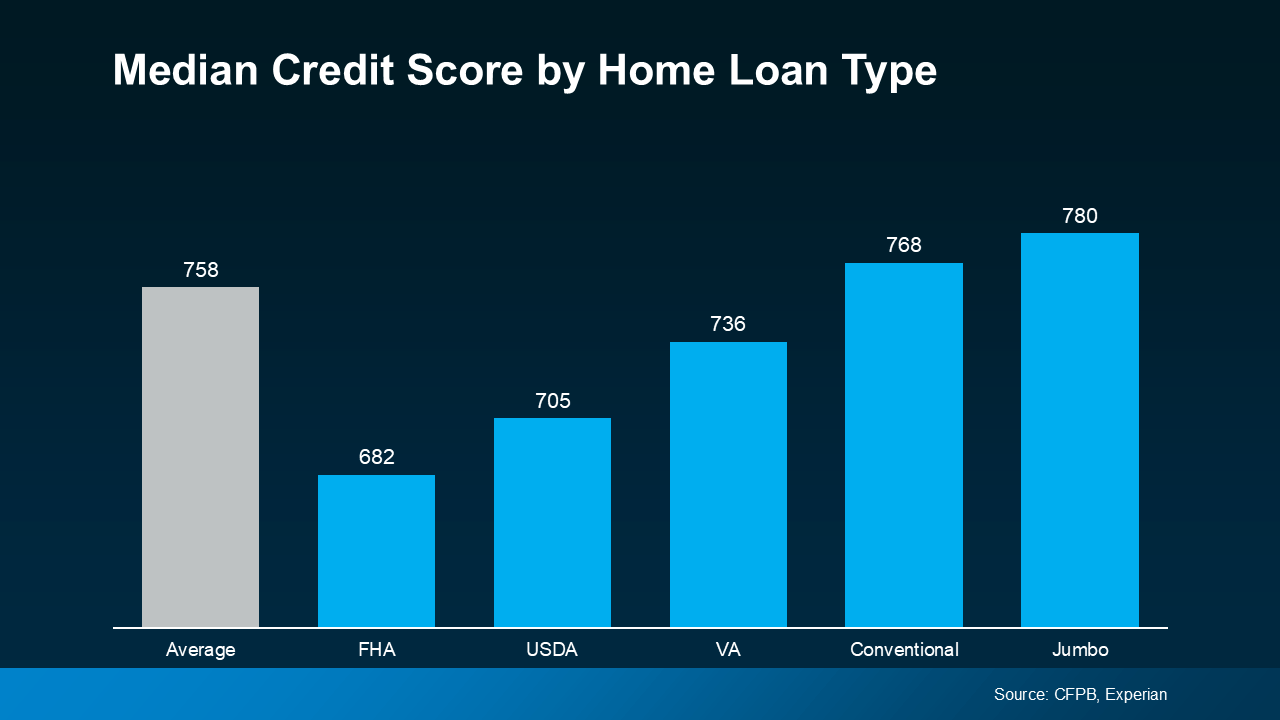

There’s no universal credit score you absolutely have to have when buying a home. And that means there’s more flexibility than most people realize. Check out this graph showing the median credit scores recent buyers had among different home loan types:

Here's what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

Here's what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

When you buy a home, lenders use your credit score to get a sense of how reliable you are with money. They want to see if you typically make payments on time, pay back debts, and more.

Your score can impact which loan types you may qualify for, the terms on those loans, and even your mortgage rate. And since mortgage rates are a big factor in how much house you’ll be able to afford, that may make your score feel even more important today. As Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

That still doesn’t mean your credit has to be perfect. Even if your credit score isn’t as high as you’d like, you may still be able to get a home loan.

And if you talk to a lender and decide you want to improve your score (and hopefully your loan type and terms too), here are a few smart moves according to the Federal Reserve Board:

Your credit score doesn’t have to be perfect to qualify for a home loan. But a better score can help you get better terms on your home loan. The best way to know where you stand and your options for a mortgage is to connect with a trusted lender.

KCM Articles

August 7, 2025

In a market with more listings and pickier buyers, many sellers who try to sell on their own end up working with an agent anyway. So why not start there?

KCM Articles

July 31, 2025

Overpricing can lead to tough choices you never want to face. But with the right price, and the right guidance, you can skip the stress and sell with confidence. Let’s… Read more

July 30, 2025

When selling your house, the price you choose isn’t just a number, it's a strategy.

KCM Articles

July 30, 2025

Your credit score doesn’t have to be perfect to qualify for a home loan. But a better score can help you get better terms on your home loan. The best way to know where… Read more

October 25, 2023

Understanding the sources of mortgage funds: Fannie Mae, Freddie Mac, and Ginnie Mae.

October 18, 2023

Understand the dangers of lead poisoning and how it affects real estate transactions.

October 11, 2023

A step-by-step guide to selling your home successfully.

October 4, 2023

Understand the facts about homeownership in today's market.

September 27, 2023

Is a biweekly mortgage right for you? Explore the pros, cons, and alternatives.

Michael M. Adams brings 23+ years of DMV-area experience, triple-state broker licensing, and a 5-star track record. Let him guide your buying, selling, or investment journey with skill, insight, and unwavering dedication.